On the First 2500. This is a list of Malaysian states and federal territories sorted by their gross domestic product.

Does Denmark Need Yet Another Tax Reform Ecoscope

The GST standard rate has been revised to 0 beginning the 1st of June 2018 pending the total removal of the Goods and Services Tax Act in parliament.

. By May 2018 the new Malaysian government led by Mahathir Mohamad decided to reintroduce the Sales and Services tax after completely scrapping GST. Assessment Year 2018-2019 Chargeable Income. SST Treatment in Designated Area and Special Area.

Malaysia Personal Income Tax Information on Employers Responsibilities Employees Responsibilities Partnerships Responsibilities FAQs and Planning. Basic supporting equipment for disabled self spouse child or parent. 0 tax rate new investment in manufacturing sector with capital investment of RM300 million - RM500 million 10.

The unemployment rate in Malaysia declined to 39 percent in April 2022 from 46 percent in the same month a year earlier as the economy recovered from the coronavirus disruptions. The tax rate you are charged with increases as your chargeable income does. Relocation of overseas business operationsfacilities to Malaysia Manufacturing and selected services sector application received by 31122022 New company.

Want the ACA rate to be used and has chosen the IA rate of 20 and the AA of 14 for the year of assessment 2018. Here are the tax rates for personal income tax in Malaysia for YA 2018. Malaysia follows a progressive tax rate from 0 to 28.

73 Control Equipment Income Tax Qualifying Plant Allowances Control Equipment Rules 1998 PU. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. For 2022 the central bank maintained its GDP outlook at 53-63 with inflation projected to average between 22 and 32.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. See information about unclaimed refunds for details. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a.

In 2020 the East Malaysian state of Sabah had the highest rate of poverty in Malaysia with 253 percent of the population living below the poverty line. The more you reduce your chargeable. This is only if you expect.

The personal savings rate reached its highest level in 2020 when it amounted to 163 percent. Malaysia Sales Tax 2018. Ducation fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

The latest reading dipped below 4 for the first time since the COVID-19 outbreak began in early 2020. The number of unemployed dropped 126 percent from a year earlier to 6493 thousand while employment increased. GDP Annual Growth Rate in Malaysia averaged 426 percent from 2000 until 2022 reaching an all time high of 1610 percent in the second quarter of 2021 and a record low of -1720 percent in the second quarter of 2020.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Unfortunately if you owe taxes there is no time limit. On the First 5000.

Malaysia Service Tax 2018. On the First 5000. On the First 5000 Next 15000.

As of 30 October 2021 1 Malaysian Ringgit symbol. For all other back taxes or previous tax years its too late. Example 3 Same facts as in Example 2 except that KASB chose to claim ACA on the plant at a rate of 60 for IA and 14 for AA.

Prices do not include sales tax. On the First 5000 Next 15000. Chargeable Income RM Calculations RM Rate Tax M 0 5000.

Calculations RM Rate TaxRM 0 - 5000. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Rate TaxRM A.

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. Please click Income Tax Rates for details about the personal income tax rate. Zero-rated and exempted supplies.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Income Tax Malaysia 2018 Mypf My

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

A Successful Journey Costa Rica S Economic Reforms 2015 2020 Ecoscope

Income Tax Malaysia 2018 Mypf My

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

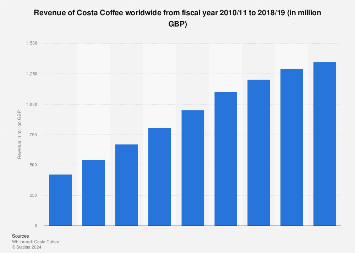

Costa Coffee Revenue 2010 2018 Statista

Income Tax Malaysia 2018 Mypf My

Most Expensive Housing Markets Globally 2020 Statista

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Malaysian Tax Issues For Expats Activpayroll

Why It Matters In Paying Taxes Doing Business World Bank Group

Pin On Gst Accounting Software Services

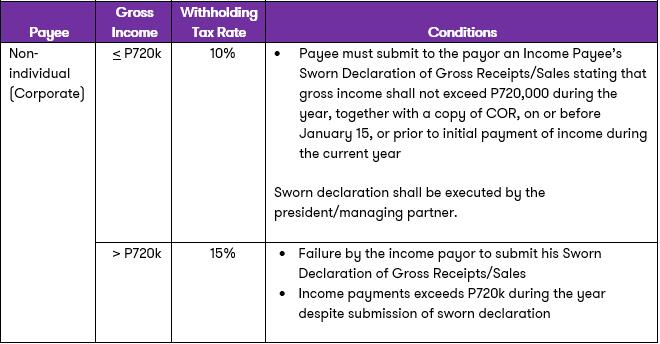

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Malaysia 2018 Mypf My

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope